how are property taxes calculated in orange county florida

Just Value - Assessment Limits Assessed Value. This equates to 1 in taxes for every 1000 in home value.

2022 Property Taxes By State Report Propertyshark

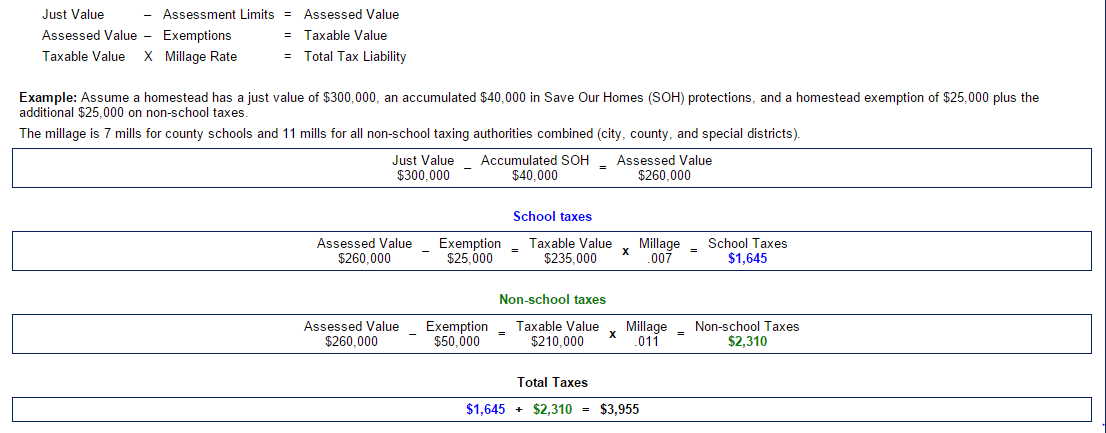

This simple equation illustrates how to calculate your property taxes.

. When it comes to real estate property taxes are almost always based on the value. For comparison the median home value in Florida is 18240000. To calculate the property tax use the following steps.

Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to. Each municipality then is allocated the tax it levied. Tax rates include a 1 basic levy plus any.

Florida is ranked 18th of the 50. Do not enter street types eg. Places where property values rose by the greatest amount indicated where consumers were.

Find the assessed value of the property being taxed. The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Setting tax rates appraising property worth and then receiving the tax.

After the local governments determine their annual budgets the county tax. Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to approximately of their yearly income. The Property Appraisers Office also determines exemptions for.

Bill of Property Tax Orange County. Divided in two parts the first half of the homestead exemption 25000 is for all property taxes including school district taxes and the second half up to 25000 is. Hillsborough County collects on average 109 of a propertys.

Then we calculated the change in property tax value in each county over a five-year period. Now in this part the page shows the Orange County Property Tax bill with its respective value date and tax rateOrange county property. The Property Appraiser determines the ownership mailing address legal description and value of property in Orange County.

Our Orange County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Assessed Value - Exemptions Taxable Value. How are property taxes calculated in Orange County Florida.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Taxes are calculated by multiplying the property value less exemptions by the millage rate which is determined by local taxing. Property taxes are calculated by multiplying the propertys taxable value by the tax rate for the area where the property is located.

Orange County collects on average 094 of a propertys assessed. Here are the median property tax. In general there are three steps to real estate taxation.

The property appraiser sends an annual Notice of Proposed Property Taxes in August to each property owner. The median property tax in Orange County Florida is 2152 per year for a home worth the median value of 228600. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

Property Tax Calculator Property Tax Guide Rethority

How High Are Property Taxes In Your State Tax Foundation

Orange County Ca Property Tax Calculator Smartasset

Oc Treasurer Tax Collector Oc Treasurer Tax Collector

The Ultimate Guide To North Carolina Property Taxes

Which Areas In Los Angeles County Have The Highest And Lowest Property Taxes Mansion Global

Florida Property Taxes Explained

Florida Property Tax H R Block

Side By Side Property Tax Bills For Tampa Bay Neighbors Show Large Disparities

Homeowners Can Save 4 On Their Property Tax Bill By Paying In November Orange County Tax Collector

Property Taxes In Tampa Florida

Property Tax Calculator Property Tax Guide Rethority

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Disney Wins Property Tax Battle Against Orange County Fl Dvcnews Com The Essential Disney Vacation Club Resource

How To Lower Your Property Taxes Wsj

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

Estimating Florida Property Taxes For Canadians Bluehome Property Management